The Corporate Sustainability Reporting Directive (CSRD) is the new EU reporting guideline that requires all large companies to publish regular reports on their environmental and social impact activities.

This soon-to-be mandatory regulation helps evaluate non-financial performance not only for investors but also for consumers, policymakers, and other key stakeholders. Replacing the current Non-Financial Reporting Directive (NFRD), CSRD will take effect for the largest listed companies as early as the fiscal year 2024. What makes this directive stand out are the requirements. They are extensive and specific, thus requiring a lot of effort from brands and businesses to comply with the CSRD.

To smoothly navigate the new Corporate Sustainability Reporting Directive (CSRD) and ensure your company is ready in time, it's essential to understand key aspects of the regulation. Here's everything you need to know:

To smoothly navigate the new Corporate Sustainability Reporting Directive (CSRD) and ensure your company is ready in time, it's essential to understand key aspects of the regulation. Here's everything you need to know:

Key aspects of CSRD:

- The CSRD takes sustainability in a comprehensive manner, requiring to disclose a wide range of Environmental, Social and Governance (ESG) aspects.

- Starting with the fiscal year 2024, the CSRD will be applicable to major publicly listed companies, affecting many businesses currently NOT covered by the NFRD.

- To comply, companies must collect, process, and publish a substantial volume of data and information. That will require novel systems, streamlined processes, and a well-structured governance framework.

- Under the CSRD, sustainability reporting will require assurance from an external auditor, initially providing limited assurance and later evolving into reasonable assurance.

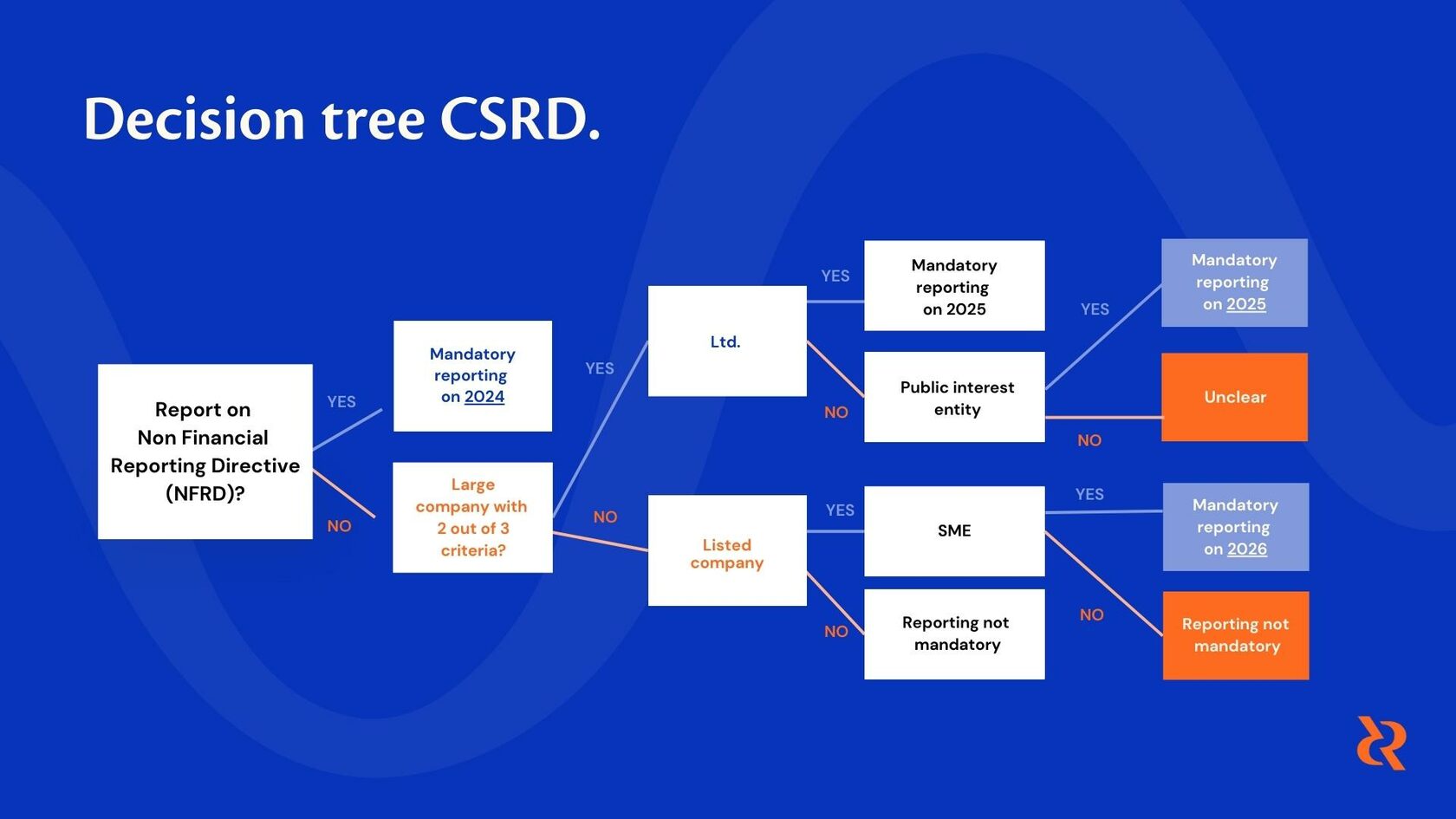

Which companies will be applicable?

With the expanded scope of the CSRD, the number of entities reporting their non-financial data will significantly increase. Currently, approximately 11,600 entities fulfil this reporting requirement. Under the new directive, nearly 50,000 businesses will be obliged to submit their non-financial data, covering more than 75% of total EU companies’ turnover.

To fall under the compliance of the CSRD, companies must meet at least two of the following three criteria:

Crucially, the implications of the CSRD reach beyond EU-based companies, as it applies to any company meeting specific conditions:

If both conditions apply, the non-EU corporation falls under the reporting obligation of the CSRD. In such cases, the EU subsidiary or branch is responsible for publishing the sustainability report of the third-country company on all relevant business activities occurring within the EU.

While the CSRD doesn't introduce new requirements for unlisted small and medium-sized enterprises (SMEs) unless they are capital-oriented, the EU Commission intends to establish separate sustainability reporting standards for these types of businesses in the future. For this reason, we recommend all small and medium companies do their due diligence as well.

To fall under the compliance of the CSRD, companies must meet at least two of the following three criteria:

- Turnover exceeding €50 million per year

- Total assets surpassing €25 million

- More than 250 employees

Crucially, the implications of the CSRD reach beyond EU-based companies, as it applies to any company meeting specific conditions:

- Operating one large or listed EU subsidiary OR one branch with a net turnover of €40 million within the EU

- Generating a net turnover of over €150 million on the European market in the last two consecutive financial years

If both conditions apply, the non-EU corporation falls under the reporting obligation of the CSRD. In such cases, the EU subsidiary or branch is responsible for publishing the sustainability report of the third-country company on all relevant business activities occurring within the EU.

While the CSRD doesn't introduce new requirements for unlisted small and medium-sized enterprises (SMEs) unless they are capital-oriented, the EU Commission intends to establish separate sustainability reporting standards for these types of businesses in the future. For this reason, we recommend all small and medium companies do their due diligence as well.

When will the CSRD take effect?

The CSRD will take effect in several stages, targeting various categories of companies:

Even despite a one-year delay from the original proposals, the implementation schedule for the CSRD remains tight. Large listed companies within the scope of the NFRD must be prepared to report under the CSRD standards from early 2024, having only a few months left to get ready for necessary changes.

- Companies already subject to the NFRD as of fiscal year 2024 (reporting in 2025 on 2024 data)

- Large companies meeting 2 out of 3 criteria as of fiscal year 2025

- Listed SMEs as of fiscal year 2026

- Non-EU companies meeting the criteria as of fiscal year 2028

Even despite a one-year delay from the original proposals, the implementation schedule for the CSRD remains tight. Large listed companies within the scope of the NFRD must be prepared to report under the CSRD standards from early 2024, having only a few months left to get ready for necessary changes.

What are the reporting requirements?

Under the CSRD, companies are required to disclose various aspects of their sustainability strategies. That includes publishing information about their sustainability strategy, targets, policies, measures, and methods used to monitor and report progress in this area.

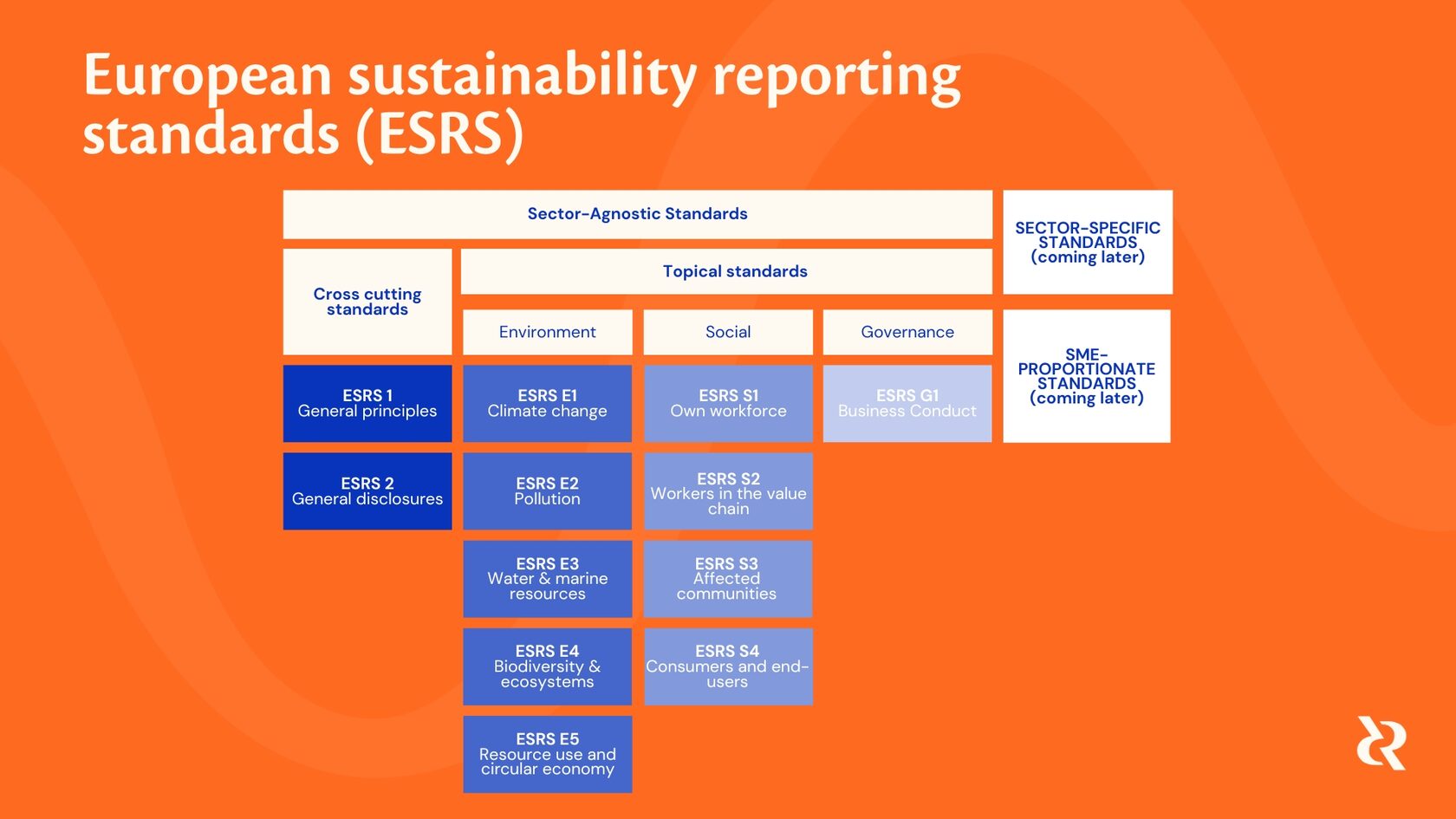

At the core of the CSRD lies the European Sustainability Reporting Standards (ESRSs). The first set of ESRSs was submitted in November 2022 and later revised in June 2023. The goal is to pass the final standards as law by the end of August 2023.

The ESRSs consist of 12 standards. The first two standards are of a general nature, focusing on fundamental principles and guiding the reporting on strategy, governance, and decisions related to materiality. The remaining 10 standards are dedicated to various Environmental, Social, and Governance (ESG) aspects.

At the core of the CSRD lies the European Sustainability Reporting Standards (ESRSs). The first set of ESRSs was submitted in November 2022 and later revised in June 2023. The goal is to pass the final standards as law by the end of August 2023.

The ESRSs consist of 12 standards. The first two standards are of a general nature, focusing on fundamental principles and guiding the reporting on strategy, governance, and decisions related to materiality. The remaining 10 standards are dedicated to various Environmental, Social, and Governance (ESG) aspects.

General standards

Environmental Standards

Social Standards

Governance Standards

- General principles

- General disclosures

Environmental Standards

- Climate change

- Pollution

- Water & marine resources

- Biodiversity & ecosystems

- Resource use & circular economy

Social Standards

- Own workforce

- Workers in the value chain

- Affected communities

- Consumers and end-users

Governance Standards

- Business Conduct

Within the two general standards, the CSRD introduces a new requirement: double materiality.

This principle mandates companies to report from two distinct perspectives:

As a result, the previous comply-or-explain approach of the NFRD will no longer be applicable under the CSRD's more comprehensive reporting framework.

This principle mandates companies to report from two distinct perspectives:

- The “outside-in” perspective: how each sustainability aspect impacts the company itself

- The “inside-out” perspective: how each aspect of their reporting influences people, stakeholders, and the environment

As a result, the previous comply-or-explain approach of the NFRD will no longer be applicable under the CSRD's more comprehensive reporting framework.

What is the scope of the reporting?

To give an example of what is required and the level of specificity and detail involved, let's examine the fourth standard under the environment theme: biodiversity and ecosystems.

This standard consists of six requirements, categorised into four topics:

These requirements highlight the meticulous level of reporting needed under the new directive to cover just one of the 12 standards under the CSRD.

This standard consists of six requirements, categorised into four topics:

- Governance: This section covers aspects such as the internal pricing methodology related to biodiversity and ecosystems.

- Strategy: Companies need to report on their plan to achieve no net loss of biodiversity from 2030 onward and no net gain after 2050.

- Impact, Risk, and Opportunity Management: This category entails disclosing the processes used to identify material risks to biodiversity and ecosystems, along with the policies implemented to manage them.

- Targets and Performance Measures: Among other things, this section addresses the financing of projects aimed at reducing risks and damage to biodiversity and ecosystems outside the company's value chain (this part is optional).

These requirements highlight the meticulous level of reporting needed under the new directive to cover just one of the 12 standards under the CSRD.

How to report on CSRD?

With the CSRD in place, sustainability reporting becomes mandatory and an integral part of management reports. Separate sustainability reporting is no longer optional, as with the NFRD, emphasizing the strategic importance of sustainability in business activities.

The report needs to be accompanied by an assurance statement by an external auditor. At this point, the assurance is required at a limited level, which entails:

The purpose of these requirements is to ensure the quality, reliability, transparency, and comparability of ESG (Environmental, Social, and Governance) information to the level of current financial disclosure.

The report needs to be accompanied by an assurance statement by an external auditor. At this point, the assurance is required at a limited level, which entails:

- Integration in Auditor’s Report

- Involvement of key audit partner

- Scope to include EU Taxonomy and process to identify key relevant information

The purpose of these requirements is to ensure the quality, reliability, transparency, and comparability of ESG (Environmental, Social, and Governance) information to the level of current financial disclosure.

Take action

Once the CSRD is in full effect, businesses are required to provide a holistic view of sustainability, disclosing their sustainability plans and objectives and creating a comprehensive picture of the company’s current and future sustainability efforts.

Don’t know where to start? Get ready for this reporting directive with RethinkRebels: experts on sustainability with more than 25 years of experience, primarily in the fashion and textile industry, that have already produced many sustainability reports with brands of various sizes. Book a call with one of our experts for a tailored solution regarding this upcoming regulation.

Disclaimer: The legislation hosted on this website is provided for informational purposes only and is not the official version. While we strive to ensure the accuracy of the information presented, we make no guarantees, express or implied, as to the completeness, timeliness, or accuracy of the information provided. Furthermore, please note that this website is not affiliated with any governmental agency, and the legislation presented may not be the most current version available. We strongly recommend that you consult with a licensed attorney or the official source to verify the accuracy and completeness of the legislation before taking any action based on the information presented on this website. By using this website, you acknowledge and agree that we are not liable for any damages or losses that may arise from your reliance on the information presented. You also agree to hold harmless and indemnify the website owner and its affiliates from any claims or liabilities arising from your use of this website.

Don’t know where to start? Get ready for this reporting directive with RethinkRebels: experts on sustainability with more than 25 years of experience, primarily in the fashion and textile industry, that have already produced many sustainability reports with brands of various sizes. Book a call with one of our experts for a tailored solution regarding this upcoming regulation.

Disclaimer: The legislation hosted on this website is provided for informational purposes only and is not the official version. While we strive to ensure the accuracy of the information presented, we make no guarantees, express or implied, as to the completeness, timeliness, or accuracy of the information provided. Furthermore, please note that this website is not affiliated with any governmental agency, and the legislation presented may not be the most current version available. We strongly recommend that you consult with a licensed attorney or the official source to verify the accuracy and completeness of the legislation before taking any action based on the information presented on this website. By using this website, you acknowledge and agree that we are not liable for any damages or losses that may arise from your reliance on the information presented. You also agree to hold harmless and indemnify the website owner and its affiliates from any claims or liabilities arising from your use of this website.